Property Tax Refunds

The Minnesota Department of Revenue provides for two types of property tax refunds:

- Regular Homestead Credit Refund: for homesteaders whose property taxes exceed a specified percentage of household income. For taxes payable in 2023, the homeowner’s household income must have been less than $128,280 in 2022 to be eligible.

- Special Homestead Credit Refund: for homestead properties where the net property tax increase exceeds a set percentage, and the increase is $100 or more (the tax increase cannot be due to new construction). There is no income limitation for this refund. For property taxes payable in 2023 only, the percentage increase must be six percent or more, and the maximum refund is $2,500.

Both of these programs are operated by the State of Minnesota, more information is available at the Department of Revenue website or by calling (800) 652-9094. Applications are due by August 15th.

Cell Tower/Array Survey

For the 2024 assessment, the St. Louis County Assessor’s Department is revaluing all cellular array and tower sites throughout the county.

We will be estimating these values using the income approach. In order to make the most accurate assessment, we are requesting income and expense data from cell tower and array sites. Please click on the link below to submit this information.

Estimated Market Values & Valuation Notices

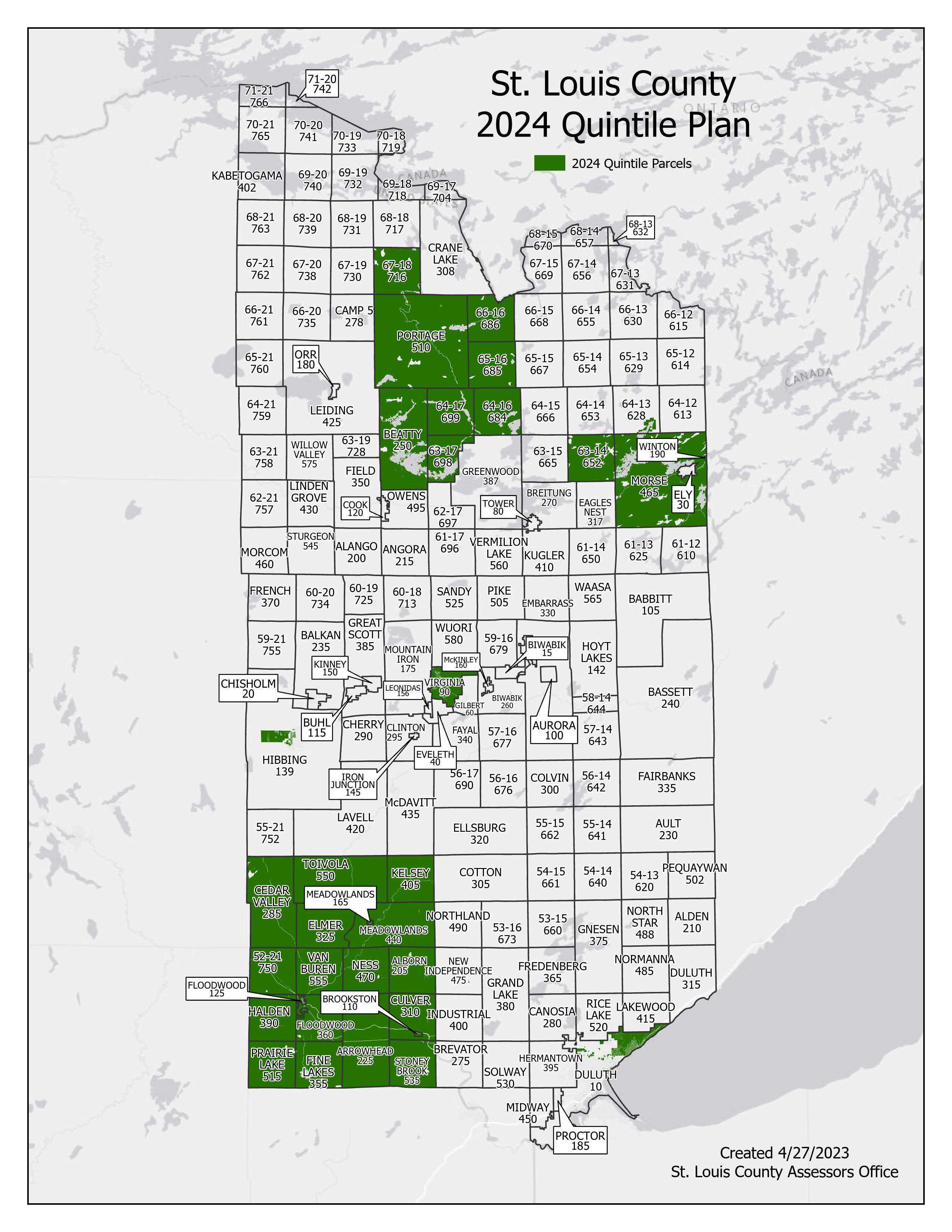

Reappraisal Areas for 2024 Assessment (Taxes Payable 2025)

Below is a map of the areas scheduled for reappraisal this year. For jurisdictions scheduled for reappraisal this year, an appraiser from our office will be visiting your property at some point in the next few months. The appraiser will have county identification and will be requesting permission to view the interior of your property, which you may decline. If you are not at home at the time, the appraiser will leave a business card to let you know they have done an exterior inspection of your property.

This reappraisal is required by state law and is done to ensure that our property data is accurate. Accurate property data is foundational to our ability to determine a fair and equitable estimated market value of your property for tax purposes.

If you have additional questions or would like to set up an appointment for an interior inspection, please contact the closest Assessor's Office.

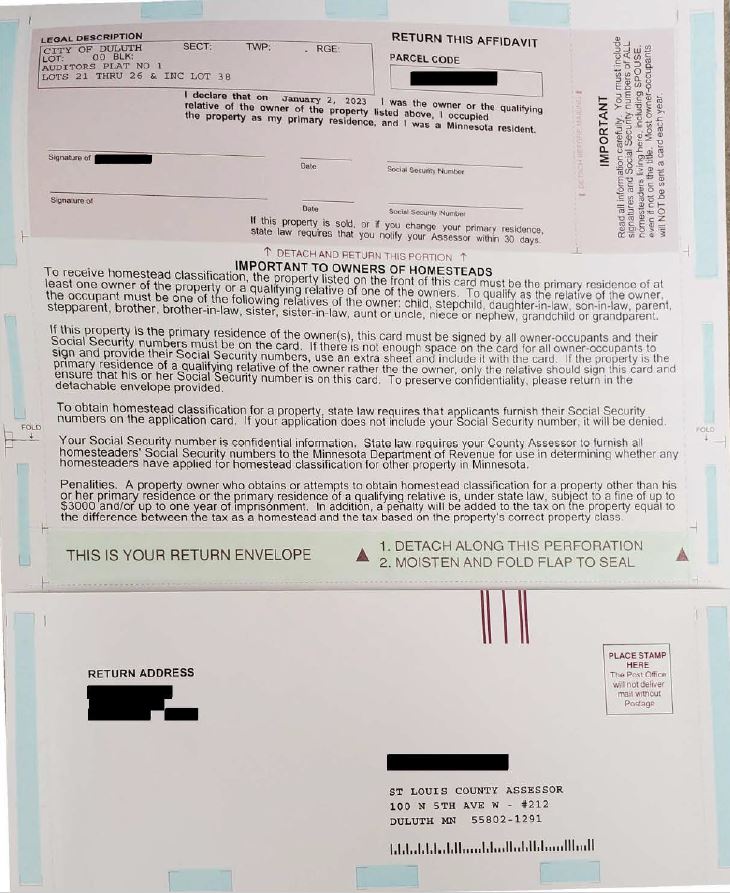

Homestead Affidavit Forms

The St. Louis County Assessor's Office is in the process of mailing out Homestead Affidavits to a portion of homeowners across the county. This is a one-off mailing in order to update our records in compliance with the Minnesota Department of Revenue standards. If the information on your affidavit card is incorrect or if you have any additional questions, please

call your nearest Assessor's office so we can assist you.

Affidavit cards may be returned by mail or in person, but copies reproduced and transmitted electronically (by email or fax) will not be accepted.

Persons with concerns about what information is required in their homestead application or affidavit may refer to the governing statute for review.

Timely, Uniform, Fair

The St. Louis County Assessor's Department is responsible for the equalization of property assessments throughout St. Louis County, including the City of Duluth. It is the Assessor's responsibility to ensure each property is equally and uniformly assessed.

To do this, the Department estimates a property's market value and classifies it according to its use for property tax purposes.

By law, every parcel in the county must be viewed by an assessor at least once every five years. In addition, every year assessors visit any parcel with new construction, alterations or improvements.